change in operating working capital formula

The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. So the Net Working Capital of Jack and Co is 80000.

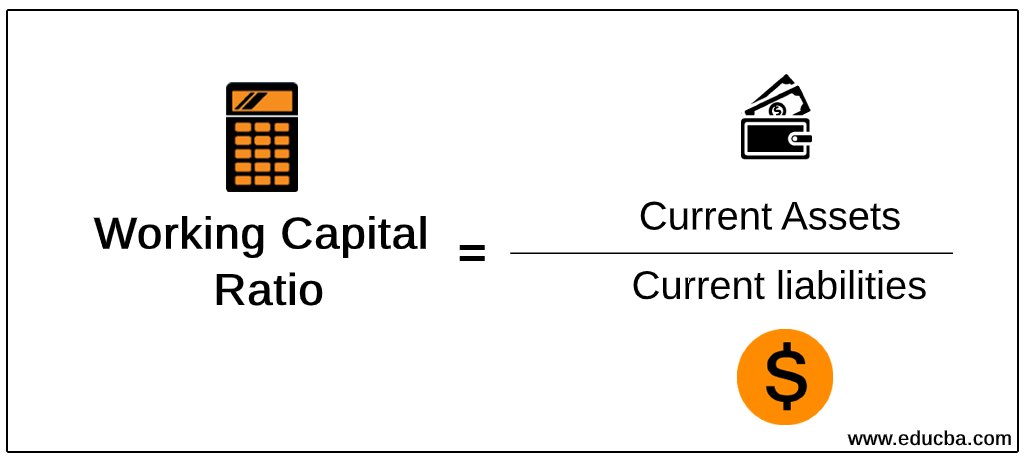

This is done simply by dividing total current assets by total current liabilities to get a ratio such as 21 twice as much in assets or 11 equal assets and liabilities.

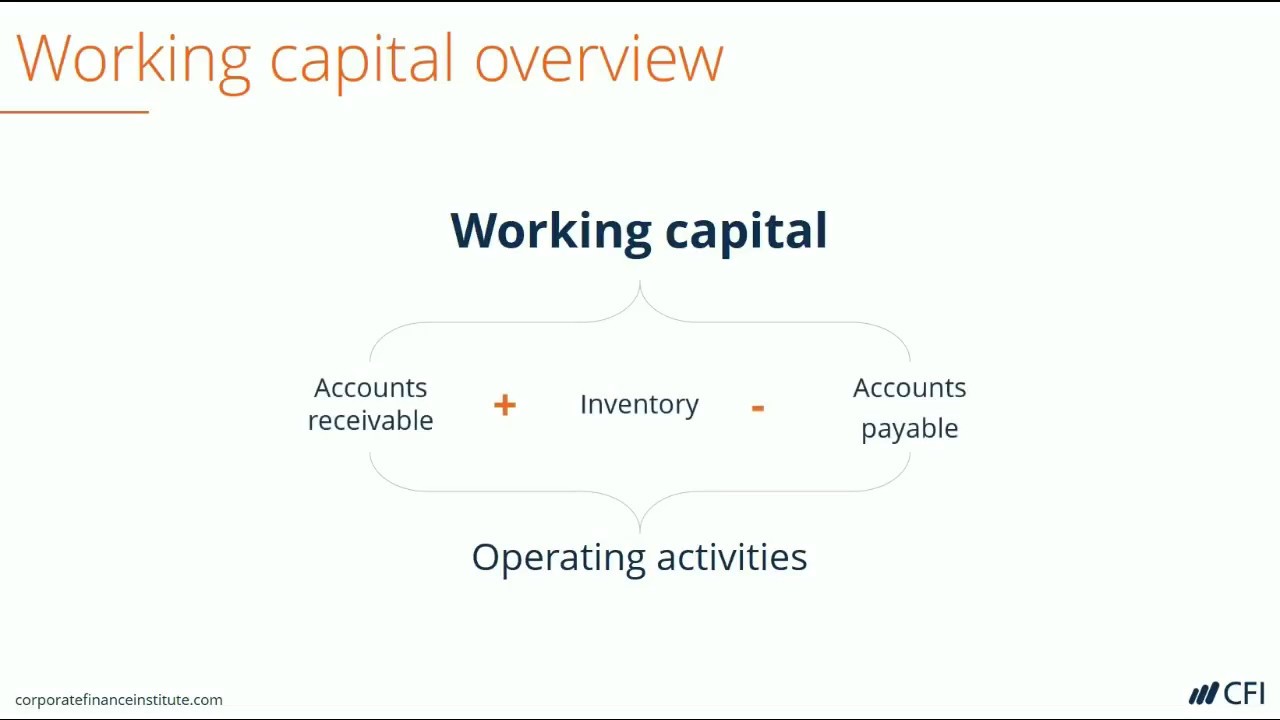

. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses. Current Assets Current Liabilities Working Capital Ratio.

Working Capital Ratio Formula. This means this amount is sufficient to pay off the current liabilities. Lets look at an example.

It means the change in current assets minus the change in current liabilities. The concept of operating working capital is a beneficial measuring stick for newer businesses. Net working capital 7793 Cr.

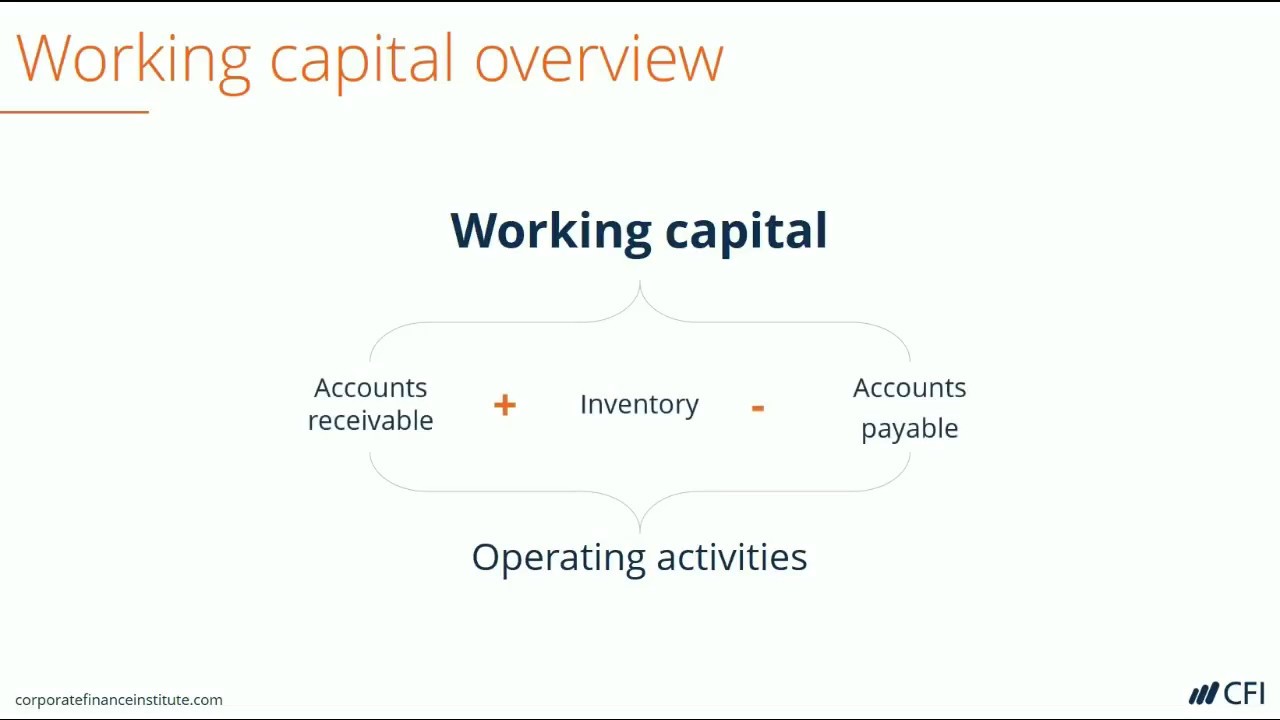

Working capital is the amount of available capital that a company can readily use for day-to-day operations. It is similar to the basic concept of working capital in that it. The definition of working capital shown below is simple.

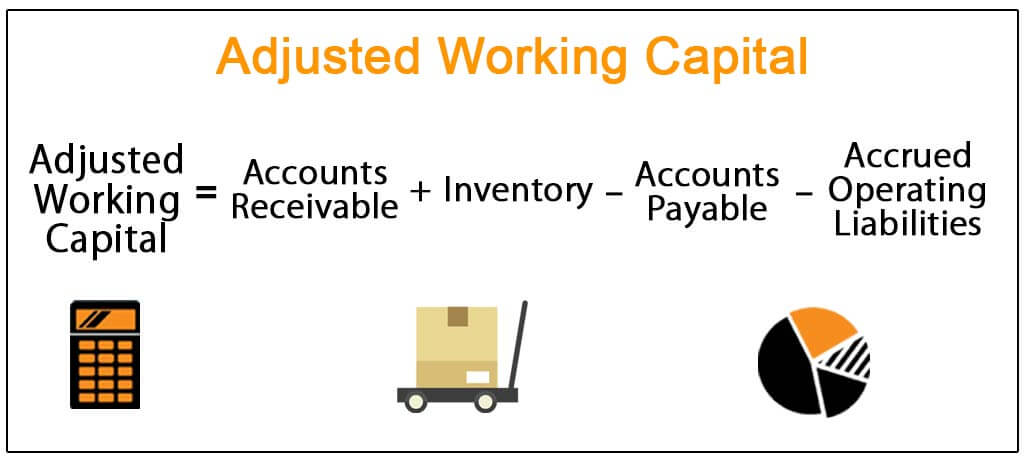

Change in Net Working Capital NWC Example Calculation Current Operating Assets 50mm AR 25mm Inventory 75mm Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm Net Working Capital NWC 75mm 60mm 15mm. Cash is excluded from Operating Working Capital as it is considered as a Non-Operating Asset. This metric is much more tied to cash flows than the net working capital calculation is because NWC includes all current assets and current liabilities.

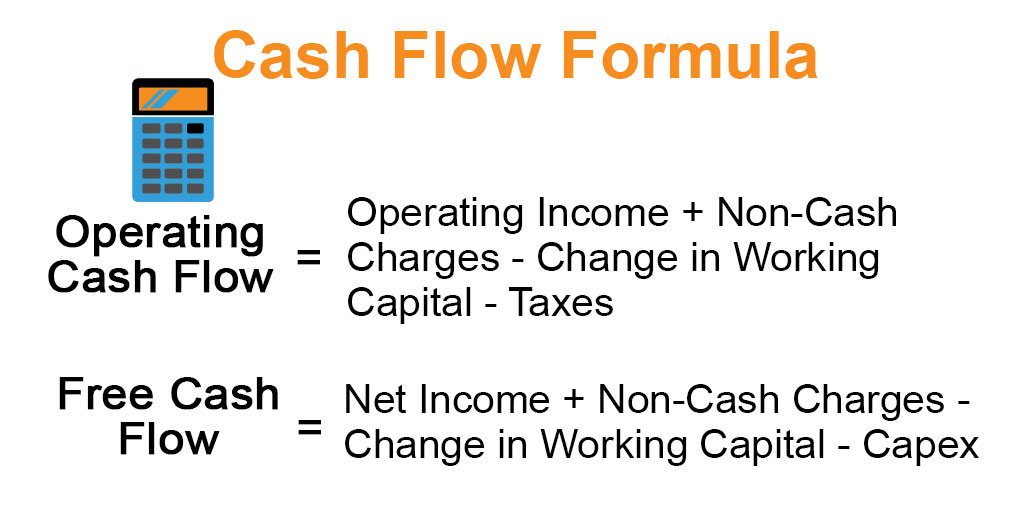

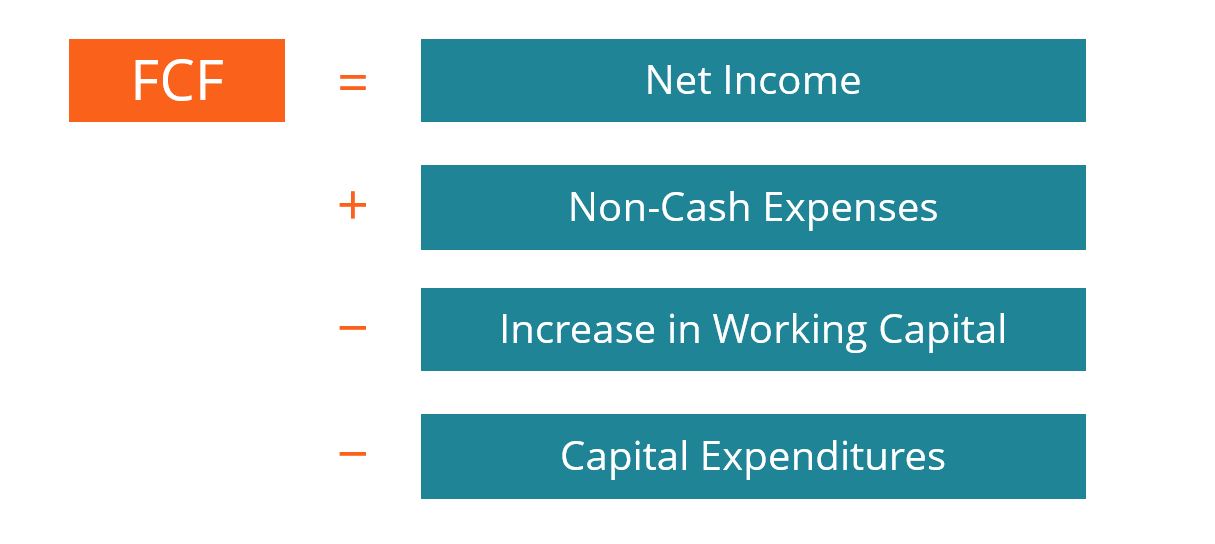

The first formula above is the broadest as it includes all accounts the second formula is more narrow and the last formula is the most narrow as it only includes three accounts. Since the change in working capital is positive you add it back to Free Cash Flow. Changes in working capital equals a change in current assets minus a change in current liabities.

Non-cash working capital 1904 335 - 1067 - 702 470 million. Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. Operating working capital OWC is a financial metric designed to accurately determine a companys liquidity and solvency.

Net Working Capital Formula Current Assets Current Liabilities Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000 80000. Whilst cash is a Current Asset the decision to. It doesnt equal an actual change from year to year.

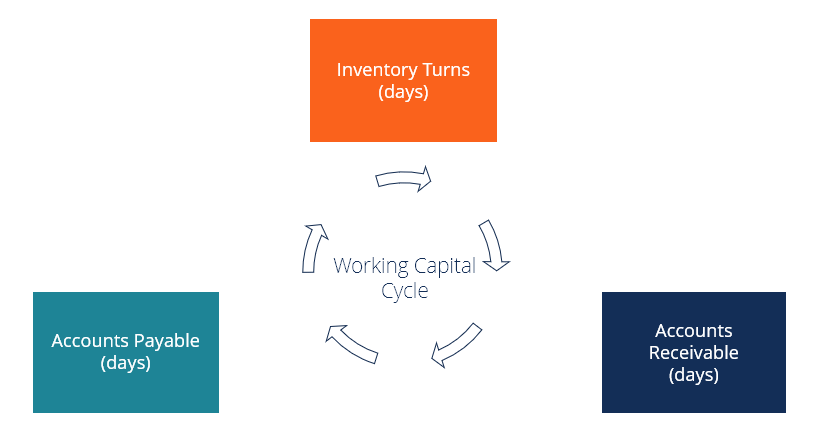

What is Financial Modeling Financial modeling is performed in Excel to. Operating Working Capital Accounts Receivable Inventory Work in Progress - Accounts Payable. Change in Working capital does mean actual change in value year over year ie.

Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable. Net Operating Working Capital Current Operating Assets Current Operating Liabilities In many cases the following formula can be used to calculate NOWC. Net working capital 106072 98279.

OWC Assets - Cash and Securities - Liabilities - Non-interest liabilities. Alternatively you can calculate a working capital ratio. The non-cash working capital for the Gap in January 2001 can be estimated.

Operating Working Capital OWC Operating Current Assets Operating Current Liabilities Key Learning Points Working capital is a measure of liquidity and calculated as current assets less current liabilities. Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. Determine whether the cash flow will increase or decrease based on the needs of the business.

Here are some examples of how cash and working capital can be impacted. In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year. Companies may over stock or under stock because of expectations of shortage of raw materials.

Net Operating Working Capital Cash Accounts Receivable Inventories Accounts Payable. Calculate the change in working capital. Add or subtract the amount.

Hence there is obviously an assumption that working capital and sales have been accurately stated. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Working Capital Current Assets Current Liabilities.

The goal is to. It tells investors how much cash the company is investing in the working capital of the business. If a transaction increases current assets and.

Working capital refers to a specific subset of balance sheet items. Changes in working capital equals a change in current assets minus a change in current liabities. Operating Working Capital OWC Operating Current Assets Operating Current Liabilities Key Learning Points Working capital is a measure of liquidity and calculated as current assets less current liabilities.

Operating working capital is the measure of all long term assets versus all long term liabilities. Net Working Capital Total Current Assets Total Current Liabilities. It measures a companys.

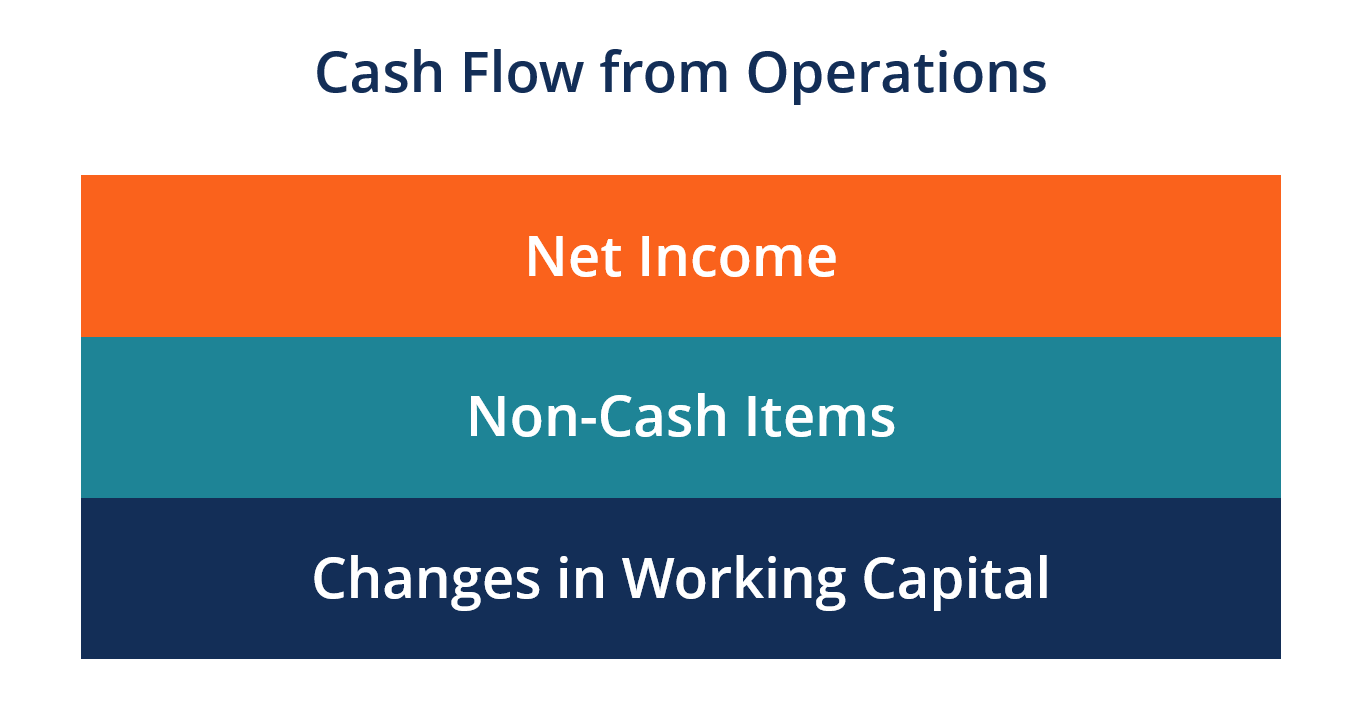

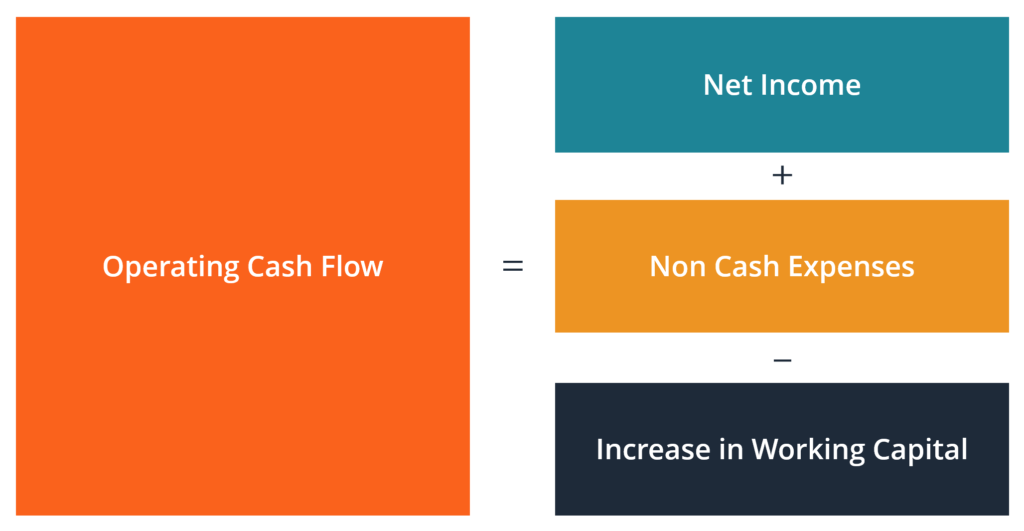

Changes in working capital are reflected in a firms cash flow statement. The formula for calculating operating working capital is. Thats why the formula is written as - change in working capital.

Working Capital Ratio Formula. A key part of financial modeling involves forecasting the balance sheet. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

Working Capital The Gap. If interest is not charged on a. Because of this NOWC is often used to calculate free cash flow.

Working capital Current assets current liabilities. Companies that have a large amount of NOWC versus their liabilities and accruals demonstrate that they have the potential to grow over time and also make investments if necessary.

Adjusted Working Capital Definition Formula Example

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

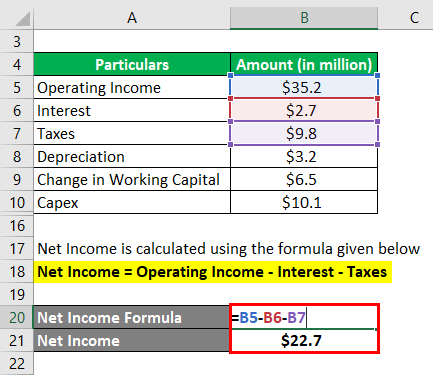

Cash Flow Formula How To Calculate Cash Flow With Examples

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow From Operations Definition Formula And Example

Working Capital Formula Youtube

Operating Cash Flow Definition Formula And Examples

Working Capital Ratio Analysis Example Of Working Capital Ratio

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Formula And Calculation Exercise Excel Template

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)