nh food sales tax

603 230-5945 Contact the Webmaster. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

New Hampshire Sales Tax Rate 2022

The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable.

. We include these in their state sales tax. State State General Sales Tax Grocery Treatment. Which to be clear happens to the best of us.

Technical information release provides immediate information regarding tax laws focused physical areas of grocery stores convenient stores and gas stations. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. 12c main street center harbor nh 03226.

A 9 tax is also assessed on motor vehicle rentals. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. B Three states levy mandatory statewide local add-on sales taxes.

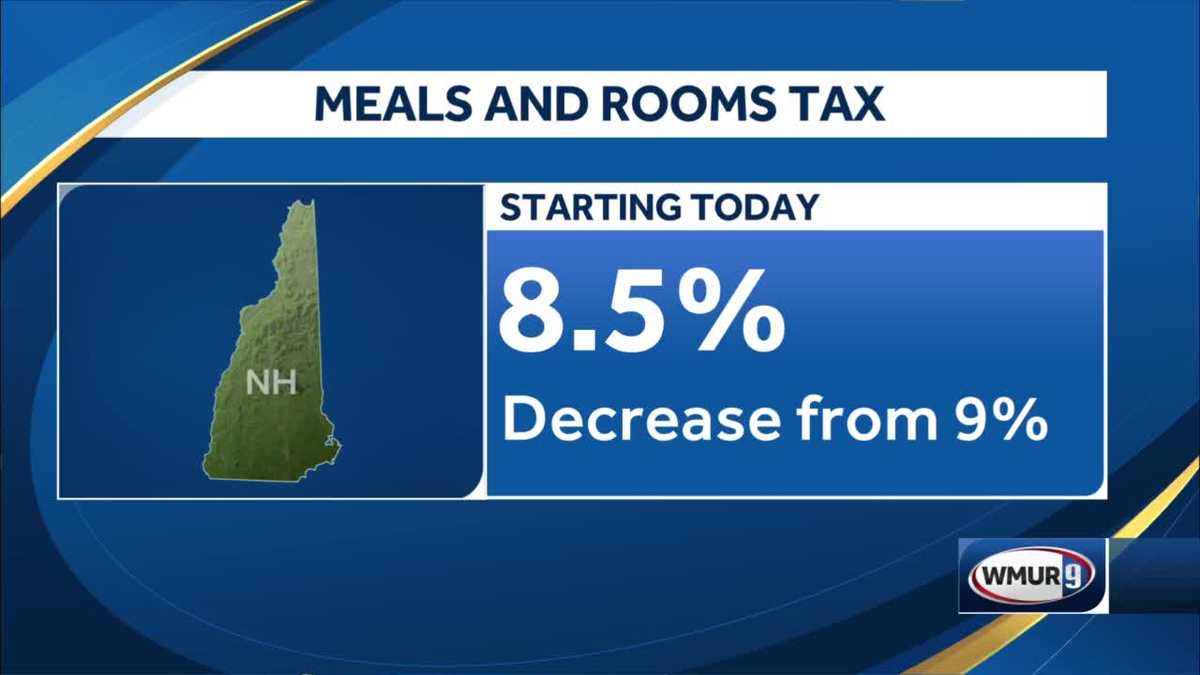

This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. Tax Rate Starting Price.

There are however several specific taxes levied on particular services or products. Additionally there are no local sales taxes in New Hampshire cities or counties. That means that nearly any product can be purchased tax-free although there are exceptions.

New Hampshire Property Tax. A More than 80 of the sellers gross receipts are from the sale of. Consumer Protection Bureau Office of the Attorney General 33.

They send the money to the state. A calculator to quickly and easily determine the tip sales tax and other details for a bill. New Hampshire is one of the few states with no statewide sales tax.

Read more about the 8080 rule here. The tax is collected by hotels restaurants caterers and other businesses. If calling to inquire about the purchase of Tobacco Tax Stamps please contact the Collections Division at 603 230-5900.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. Almost all states employ a statewide sales tax which ranges from 29 percent in Colorado to 725 percent in California.

New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. New hampshires excise tax on cigarettes totals 178 per pack of 20. New Hampshire NH sales tax is currently 0.

Food prepared on the premises as defined in Rev 70116 which could reasonably be perceived as competing with an eating establishment. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services.

It is one of only 5 states without a sales tax. The taxability of cold food sold to go in California depends in large part on the 80-80 rule. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at.

New Hampshire did not levy a sales tax in 2017. Be sure to visit our website at revenuenhgovGTC to create your account access today. Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388.

If this rule applies to you and you do not separately track sales of cold food products sold for take-out 100 of your sales are taxable. 2022 New Hampshire state sales tax. 1-888-468-4454 or 603 271-3641.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

New Hampshire Guidance on Food Taxability Released. Additionally many states allow the levying of local sales taxes which are then added to the states tax. New Hampshire is one of the few states with no statewide sales tax.

Exact tax amount may vary for different items. The state sales tax rate in New Hampshire is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. A bit of that money goes toward school building loans and tourism promotion.

There are however several specific taxes levied on particular services or products. Utility Property Tax To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Tax Returns Payments to be Filed.

Please visit GRANITE TAX CONNECT to create or access your existing account. California 1 Utah 125 and Virginia 1. Camila Cabello is busy doing press to promote her new hit single Bam Bam and showed up on BBCs The One Show where she accidentally had a nip slip.

Any New Hampshire business contacted by a state or locality regarding the collection of sales or use tax is also encouraged to contact the DOJs Consumer Protection Bureau.

New Hampshire Sales Tax Rate 2022

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

New Hampshire Sales Tax Guide And Calculator 2022 Taxjar